In today's fast-paced service setting, small organizations deal with multiple difficulties, and taking care of payroll successfully stands out as one of the most critical tasks. With the intro of financial modern technology solutions like Zil Money, little services now have the possibility to utilize modern-day financial solutions, tailored specifically for their financial needs.

The idea of utilizing a charge card to fund pay-roll could originally appear unusual, yet it's a strategy that's progressively getting grip amongst smart entrepreneur. The primary advantage right here is liquidity. Capital management is a recurring challenge for tiny services, which typically need to juggle paying distributors, operating costs, and, of program, payroll. By making use of a bank card, services can efficiently handle their capital much better. This method permits them to push settlement due dates better out, offering a much-needed cushion throughout lean times or when awaiting receivables.

Several organization credit rating cards offer luring cashback benefits, points, or take a trip miles for every dollar spent. By directing payroll costs with a credit card, organizations can accumulate considerable incentives, which can be reinvested right into the organization, made use of for traveling, or also to balance out other expenses.

There's the tax angle. The costs connected with funding payroll using bank card are taken into consideration service expenses, which suggests they can usually be crossed out throughout tax season. This reduction can potentially lower the overall tax obligation burden on business, offering one more financial advantage Payroll Cards For Small Business to utilizing this approach. It's important for local business owner to talk to a tax obligation specialist to ensure they are maximizing their reductions while remaining compliant with tax regulations.

Nonetheless, similar to any kind of economic approach, it's crucial to weigh the pros and cons. One considerable consideration is the charge card charges, which can in some cases be steep relying on the card provider and framework of the benefits program. Businesses must make certain that the advantages and rewards they are reaping surpass the expenses related to these fees. Moreover, there's a possible danger of financial obligation accumulation. If organizations don't handle their credit limitations intelligently or stop working to pay off their balances on time, they may incur passion charges, which can nullify the economic gains from benefits.

This is where monetary technology firms like Zil Money come into play, supplying remedies that are customized for small companies. The integration of financial with pay-roll and audit via Zil Money's system simplifies processing, making it less complicated for services to handle payroll, accessibility funds, and automate deals.

Zil Money's community caters especially to small to medium-sized organizations, comprehending their unique obstacles and offering customizable remedies. With advancing payroll software combinations, businesses can sync their accountancy data, streamlining settlement and guaranteeing accuracy in financial reporting. This integration is specifically valuable in an age where digital makeover and automation are not simple buzzwords yet requirements for effectiveness and competition.

In conclusion, funding pay-roll by credit scores card is not just about comfort; it's a calculated financial choice that can bolster a little business's functional efficiency and economic health and wellness. By weding traditional financial solutions through reputed organizations with innovative fintech innovations, services can not only meet their payroll responsibilities effortlessly however can also take advantage of on the associated financial perks, driving development and sustainability in the affordable market landscape.

Luke Perry Then & Now!

Luke Perry Then & Now! Jonathan Lipnicki Then & Now!

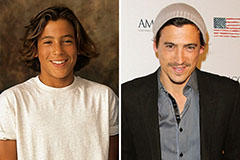

Jonathan Lipnicki Then & Now! Andrew Keegan Then & Now!

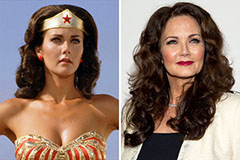

Andrew Keegan Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!